By Deepu George January 19, 2021

12 min read

By Deepu George January 19, 2021

12 min readHow Banking-as-a-Service(BaaS) drives growth in Fintech?

The banking industry is experiencing a massive technology shift. Thanks to technology innovation and ubiquitous online accessibility that pushed banks to get into the bandwagon of transformation.

Though banks initiated the process automation, they still find it difficult to pace with today’s digitized financial services that are consumer-centric. The traditional banking services are being disrupted by fintech to introduce innovative, multi-channel banking solutions. Leveraging the power of fintech to offer digitally innovative solutions such as digital wallets, P2P lending, and payments give an opportunity to engage with the tech-savvy consumers of this era. Therefore, to stay ahead in the curve and be digitally relevant, banks need to rethink their approach to service delivery.

To stay competitive, Banking-as-a-Service (BaaS) comes to your rescue. It is a toolkit that helps banks quickly enter new markets and accelerate to meet the demands of digital consumers and offer an exclusive suite of profitable services.

Before diving into the depth of BaaS, first let us see what is BaaS all about.

What is Banking-as-a-Service (BaaS)?

Banking-as-a-Service or BaaS can be termed as an end-to-end process where Fintech, non-fintech, fintech developers, or any third party can leverage the benefits of financial services by accessing and executing the services without the need for developing them.

With BaaS, third parties can access the bank’s core systems, and functionalities and integrate them with financial services like banking, payments into their tailored products. BaaS provides banks a platform to embrace a modular way of working into the fintech ecosystem and establishes a connection through APIs.

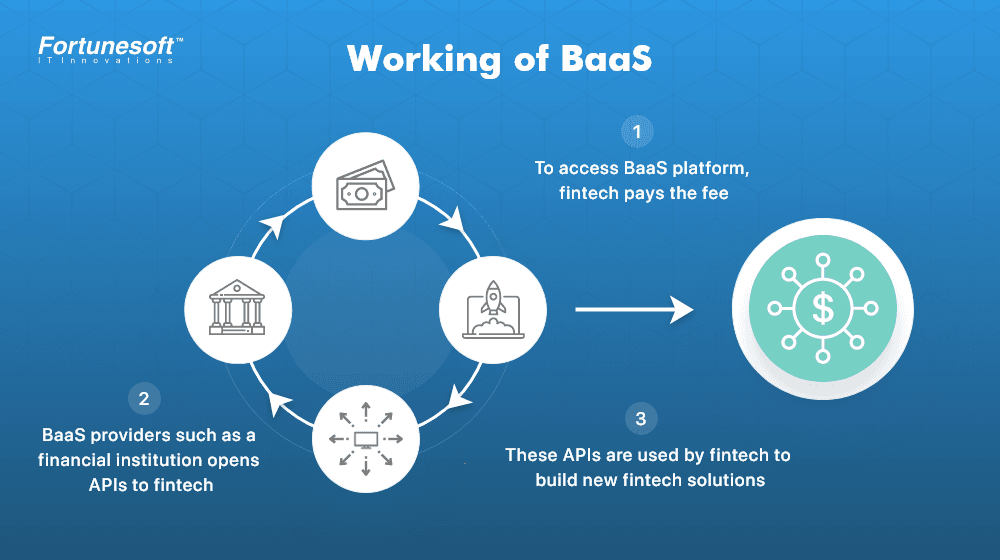

How does BaaS work?

The working of BaaS is explained in the diagram below. It has three steps:

1. Any third-party provider, for example, fintech pays a fee to access the BaaS platform. This is the first step in the BaaS process.

2. Once the request is sent by the fintech to access the BaaS platform, the financial institution opens its APIs to the third-party provider.

3. This enables the fintech to access the systems and information that helps in building new banking products and solutions.

The products that are built by the third-party providers cater to the market requirements and customer demands, focusing on enhancing the customer experience.

The 3 Key Aspects for Embracing BaaS

Banks need to embrace BaaS to succeed. To leverage the benefits of BaaS, banks need to consider the following three key aspects:

1. API revolution

With the widespread adoption of API technology, the emergence of BaaS came into existence. APIs aren’t new in the market, but for banks, their application was limited.

Earlier, third-party financial software providers would offer APIs to their clients (Banks) to meet the individual business needs by adapting to the software. Recently, the open-source wave has pushed the software vendors for making the APIs accessible to any customer who wants to use them. With more open-source movement gaining momentum, the software vendors started making their products available to the users interested in accessing them via APIs. It became a plug-and-play agreement where the buyers can ask for software and pay for their use rather than buying the entire entity. This entire process is known as Software as a Service (SaaS). This kind of service is available in Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) as well.

This business model is now knocking on the doors of Banks as well. Banks with this model will provide API access to users to their financial services. Businesses can tailor-made new products and services from a wide range of available financial services that fulfill their and their customer needs. In other words, businesses will create financial platforms through which they can offer their banking services. This is Banking-as-a-Service (BaaS).

Banks leverage the benefits of API to enable data sharing with fintech and developers. This will further help the third-party partners to develop enterprise digital solutions like mobile payments, P2P lending solutions, digital wallets, and many more for the customers. Also, with these kinds of advancements, banks need to accept their role as active participants and not owners always for the end-to-end user experience.

2. Open Banking with BaaS

With open banking, banks offer customers to access and share financial data of the customer that is owned by the bank. Open banking allows customers to compare the products offered by various financial institutions and permits them to choose the best that fits their requirements and needs. Open banking offers customers the ease of fund transfers and accounts from one financial institution to another without hassles.

But with open banking, though a customer can get information about the features of a transaction account from multiple banks, he has to transact with a bank he has an account with, which isn’t the case with BaaS. BaaS allows a customer to access the transaction services offered by any regulated bank, even if he isn’t a customer of that bank.

BaaS offers businesses to choose the best suitable products for themselves from a wide array of service providers without the concern to manage the relationship with all the service providers. Also, BaaS provides businesses with faster accessibility, payment security, and other top-notch financial services through regulated banks in spite of the fact that they don’t have an account with those banks.

3. User experience

There is a rapid shift in customer demands. Customers expect to get served as soon as possible. They expect empathy towards their problems and require an immediate solution. Financial services are quite personal, affecting everyday lives. When your business can actually solve the customers’ pain points and resonate well, establishing a connection with them, you get to win their loyalty and retention.

With the growing capabilities of technology, financial offerings have become well-suited to modernized demands of customers. There is no thumb rule where the end-user has to have knowledge of BaaS. They are only concerned with the service and product that they get is highly secure, safe, and fast.

BaaS allows the sharing of data to third-party providers. This facilitates in building innovative and highly-relevant, customer-led digital solutions such as virtual assistants, financial robo advisors, and so on. Such digital solutions attract customers and result in higher engagement with your financial services, increasing your customer base and retention rate, while reducing costs.

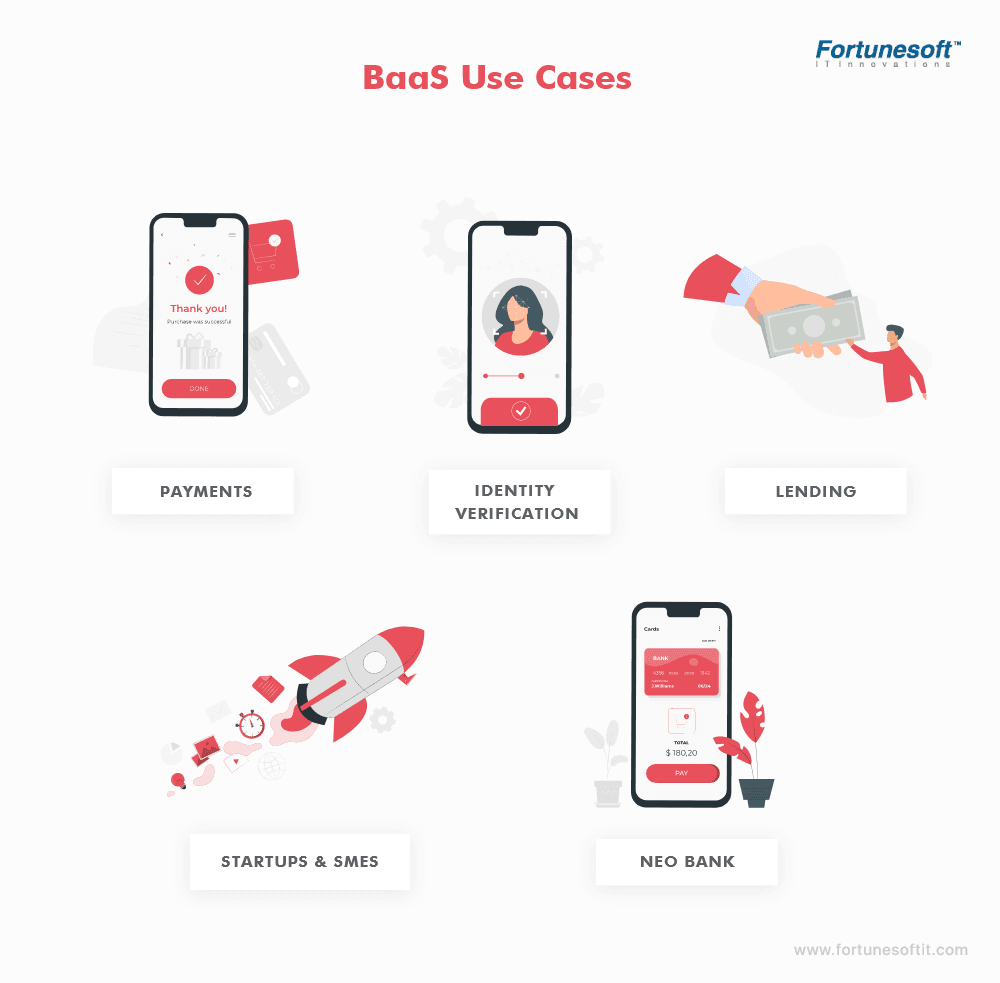

Common BaaS Use Cases

Today BaaS has some common deployments in the market. They are listed as below:

Payments

With BaaS, non-financial companies can add top-notch payment services to their tailor-made products. Such an exclusive suite of services enables firms to offer white-label debit cards that boost brand loyalty and revenue.

Identity verification

Whether financial or non-financial companies, identity verification plays a vital role in terms of security. BaaS helps firms across various industries to quickly and affordably verify their potential customers’ identities by plugging into a bank’s KYC API.

Lending

eCommerce and travel domains are the leading sectors that sell big-ticket items. With the help of a consumer lending BaaS API, these firms can provide on-platform financing. In this process, the bank(finance provider) finances the loan and helps the merchant convert big sales.

Other applications

Any organization can pick any banking service of their choice from a broad range of available banking services with BaaS. There is a possibility that a firm incorporating BaaS into its products requires a certain functionality specific to its target segment.

Many financial startups look at BaaS as an opportunity to transform the entire banking experience by creating neobanks.

Many SMEs use BaaS to provide multiple financial services right from payment cards to balance checks of customer accounts. BaaS is also used for currency exchange deployment to combat excess charges.

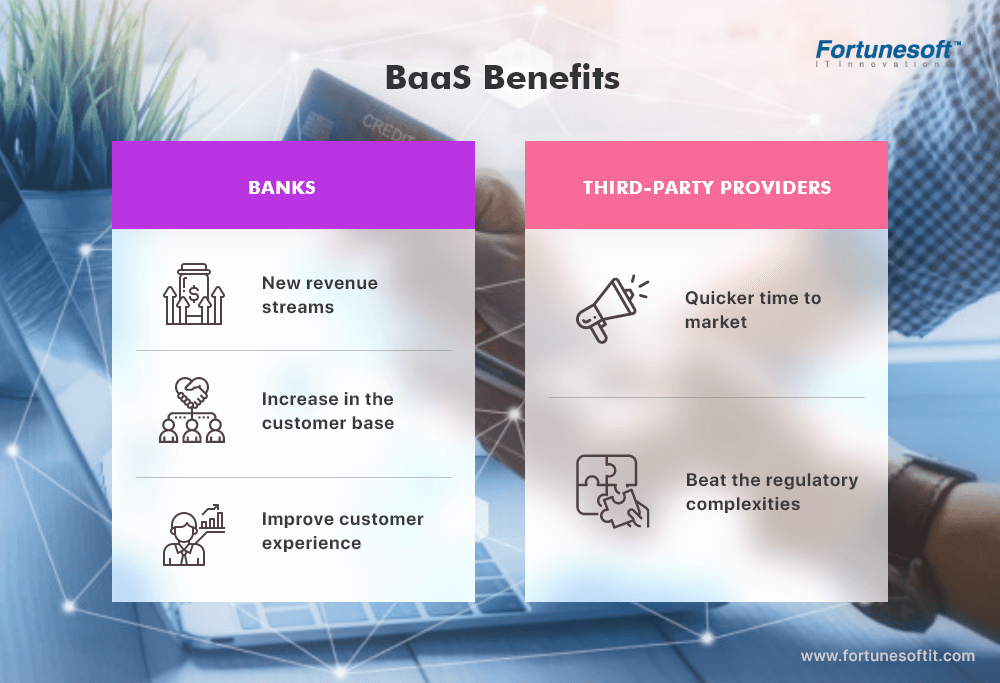

Benefits of BaaS

Banks benefit a lot by offering BaaS. They get:

1. New revenue streams: Banks always strive hard to find new ways to drive profits. To stay ahead in the competition, they require to navigate and explore competitive markets. All this has to be done while keeping the costs lower.

With BaaS, banks allow third-party providers with a fee to access their BaaS platform that creates a good revenue for the bank. Banks can have various revenue models with BaaS such as set up charges, subscription charges, recurring fees, revenue sharing, and many more.

2. Increase in the customer base: There are chances that the third-party providers may have a huge customer base who aren’t banking customers. With BaaS, banks get an opportunity to acquire new customers without incurring huge costs. This often leads to a new, profitable relationship between the bank and the customer.

3. Improve customer experience: Banks can provide an optimal customer experience by offering their BaaS platform to third-party service providers. The third-party service providers incorporate these BaaS platforms offered by banks into their fintech products and services.

In addition to banks, third-party providers get an exclusive suite of benefits with BaaS such as:

1. Quicker time to market: When third-party providers access the bank’s functionalities, they get to combat some development hurdles. This provides them with an opportunity to get to the market faster, which otherwise wouldn’t be possible if they had to build the functionality of their own from scratch.

2. Beat the regulatory complexities: Fintech or any third-party providers have to deal with complicated regulations and compliances while providing financial services to their customers. With BaaS, these third-party providers partner with banks and can deal with this problem by piggybacking onto banks’ licensing agreements.

Who is benefitted from BaaS?

A lot of benefits can be leveraged by incorporating BaaS. The following segments are benefitted from BaaS:

End-Users

BaaS provides consumers with a wide array of options to choose from various financial services provided by companies. The more the choices, the more the competition, resulting in less cost and optimized customer experience. BaaS with ML is set to create more automated personalized experiences for the masses, boosting engagement and customer retention rates.

Financial companies

BaaS brings numerous banking capabilities to financial firms that deal with accounting, corporate finance, and SME lending that gives businesses an opportunity for better services and choices.

Non-financial companies

Sectors like eCommerce and travel must prove their worth and provide a diversified revenue stream in order to survive in this competitive market, and BaaS satisfies these needs.

One of the most valuable factors for a company is to understand the customers’ behavior and spending patterns. For organizations that use BaaS, their primary source of information is the customers’ data. BaaS provides banking services to customers across a broader spectrum of industries with the help of this customer data and becomes a potent weapon in this cut-throat scenario.

Banks

Banks already bear banking licenses. By offering top-notch services to third-parties, banks with the help of BaaS can create a good value in terms of fees and deposits. Also, BaaS offers banks a transformation legacy that helps them to change their traditional stack to a modern, cloud-based tech stack.

Factors to consider while partnering with a leading fintech development company

BaaS drives innovation as organizations across various verticals want to leverage the power of cloud technology and want to incorporate banking services into their products and ecosystems.

Any innovation that happens to revolutionize the finance ecosystem is relevant to businesses from any vertical where finance is an integral part. Every company deals with transactions. They need to move money from one to another. Whether it is conducting payrolls, managing payables or receivables, loyalty programs, employee expenses, marketplaces, everywhere managing finances is a basic requirement.

Organizations are busy creating optimal customer experiences by building industry-leading fintech products across various industries, making banking and financial services a limitless opportunity.

In order to accord your customers with the right fintech solution with BaaS, you need the right technology to function correctly and the right process to maintain enhanced security levels, risk management, compliances, and regulations.

Technology: Fintech development companies provide services that enable third-parties to communicate with the banks. This is done with a cloud-native technology stack. Therefore, when you partner with a leading fintech app development company, try to understand the design and development process of your fintech product and also check if it matches your requirements of speed and agility.

One of the biggest advantages of building cloud native solutions is it gives the fintech development company an opportunity to nimble and work in an agile environment, making them easy to scale as per the market requirements.

Process: BaaS brings in a set of requirements for the companies that are looking to incorporate financial services.

BaaS makes it a mandate for companies to operate within the defined regulatory compliances and legal framework of the federal and governing bodies. This becomes one of the main challenges that BaaS comes with and companies find it often difficult to build a process around this.

However, if your partner fintech firm establishes a robust framework with diligence and monitoring with stronger lines of communication with the bank, it will reduce the time for onboarding the services of your partner firm, giving you an opportunity for quicker time to market with better banking and payments to your customers.

In a nutshell

BaaS has given a platform for both banks and third-party providers to generate higher revenue streams. With BaaS, traditional banks are challenged to become modular and platform-based to pace up in the competition in the financial ecosystem with other players in the market. This innovative and revenue-driving entity has emerged to drive growth due to the increasing competition with fintech, digital banking solutions such as digital wallets, ever changing customer demands, regulations, and compliances, and to offer optimal customer experience. BaaS offers to improve the end-to-end customer experience and acquire new customers. BaaS has a promising future with a lasting impact on banks’ growth.

Author Bio

Facebook

Facebook Whatsapp

Whatsapp LinkedIn

LinkedIn Pinterest

Pinterest

Start Chat

Start Chat